Bitcoin, the pioneering cryptocurrency, has captivated the world with its decentralized nature and potential for financial revolution. Understanding how Bitcoin operates is essential for anyone looking to delve into the realm of digital currency.

The Blockchain Technology

At the heart of Bitcoin lies blockchain technology. Blockchain serves as a distributed ledger that records all transactions across a network of computers. Each block contains a set of transactions, cryptographically linked to the preceding block, forming an immutable chain.

Cryptography: Securing Transactions

Cryptography plays a vital role in securing transactions in today’s digital landscape, particularly in the realm of online communications and financial exchanges. At its core, cryptography involves the use of mathematical techniques to encrypt and decrypt data, ensuring that only authorized parties can access and understand the information being shared. This is especially crucial in environments where sensitive data, such as personal information, financial details, or confidential communications, is at risk of interception or unauthorized access.

One of the most common applications of cryptography in securing transactions is through the use of encryption algorithms. These algorithms convert plaintext data into ciphertext, a scrambled format that is unreadable without the appropriate decryption key. For instance, when a user initiates a financial transaction online, their sensitive information—such as credit card numbers or bank account details—is encrypted before being transmitted over the internet. This ensures that even if the data is intercepted by malicious actors, it remains unintelligible and secure.

Public key cryptography is another crucial aspect of securing transactions. In this system, each participant has a pair of keys: a public key, which is shared openly, and a private key, which is kept secret. When someone wants to send a secure message, they encrypt it with the recipient’s public key. Only the recipient can decrypt it using their private key, thereby ensuring that the transaction remains confidential. This method not only secures data but also facilitates authentication, as the sender can digitally sign a transaction with their private key, allowing the recipient to verify their identity with the corresponding public key.

Blockchain technology has further revolutionized how cryptography secures transactions. Each transaction is recorded in a decentralized ledger, where cryptographic hashes link blocks of data. This creates an immutable record that is extremely difficult to alter without detection. Each block contains a unique hash of the previous block, forming a chain that ensures the integrity of the entire system. This feature of blockchain, combined with consensus mechanisms like proof-of-work or proof-of-stake, enhances security by making it nearly impossible for any single entity to manipulate transaction history.

Moreover, cryptographic protocols, such as SSL/TLS, are employed to secure online communications. These protocols establish a secure connection between web browsers and servers, encrypting the data exchanged during transactions. This is evident when users see “HTTPS” in their browser’s address bar, indicating that their connection is secure and their data is protected from eavesdropping.

In summary, cryptography is fundamental to securing transactions in the digital age. It safeguards sensitive information through encryption, ensures authenticity through public key infrastructure, and leverages innovative technologies like blockchain to maintain data integrity. As cyber threats continue to evolve, the importance of cryptographic measures in protecting transactions and maintaining trust in digital systems cannot be overstated. Understanding these cryptographic principles is essential for anyone navigating online transactions, whether in e-commerce, banking, or personal communications, as they form the backbone of security in our increasingly interconnected world.

Cryptography plays a pivotal role in securing Bitcoin transactions. Public and private keys enable users to send and receive Bitcoin securely. Transactions are verified through cryptographic algorithms, ensuring authenticity and integrity.

Mining: Securing the Network

Mining is the process by which new bitcoins are created and transactions are validated. Miners compete to solve complex mathematical puzzles, adding new blocks to the blockchain and securing the network. In return, miners are rewarded with bitcoins.

Decentralization: Eliminating Intermediaries

One of Bitcoin’s most groundbreaking features is its decentralized nature. Unlike traditional currencies, Bitcoin operates without a central authority, such as a government or financial institution. How Does Bitcoin Work This decentralization promotes transparency, security, and financial sovereignty.

Peer-to-Peer Transactions

Bitcoin enables peer-to-peer transactions, allowing users to send and receive funds directly without intermediaries. This peer-to-peer network facilitates fast, efficient, and borderless transactions, empowering individuals worldwide.

Wallets: Storing Bitcoin Securely

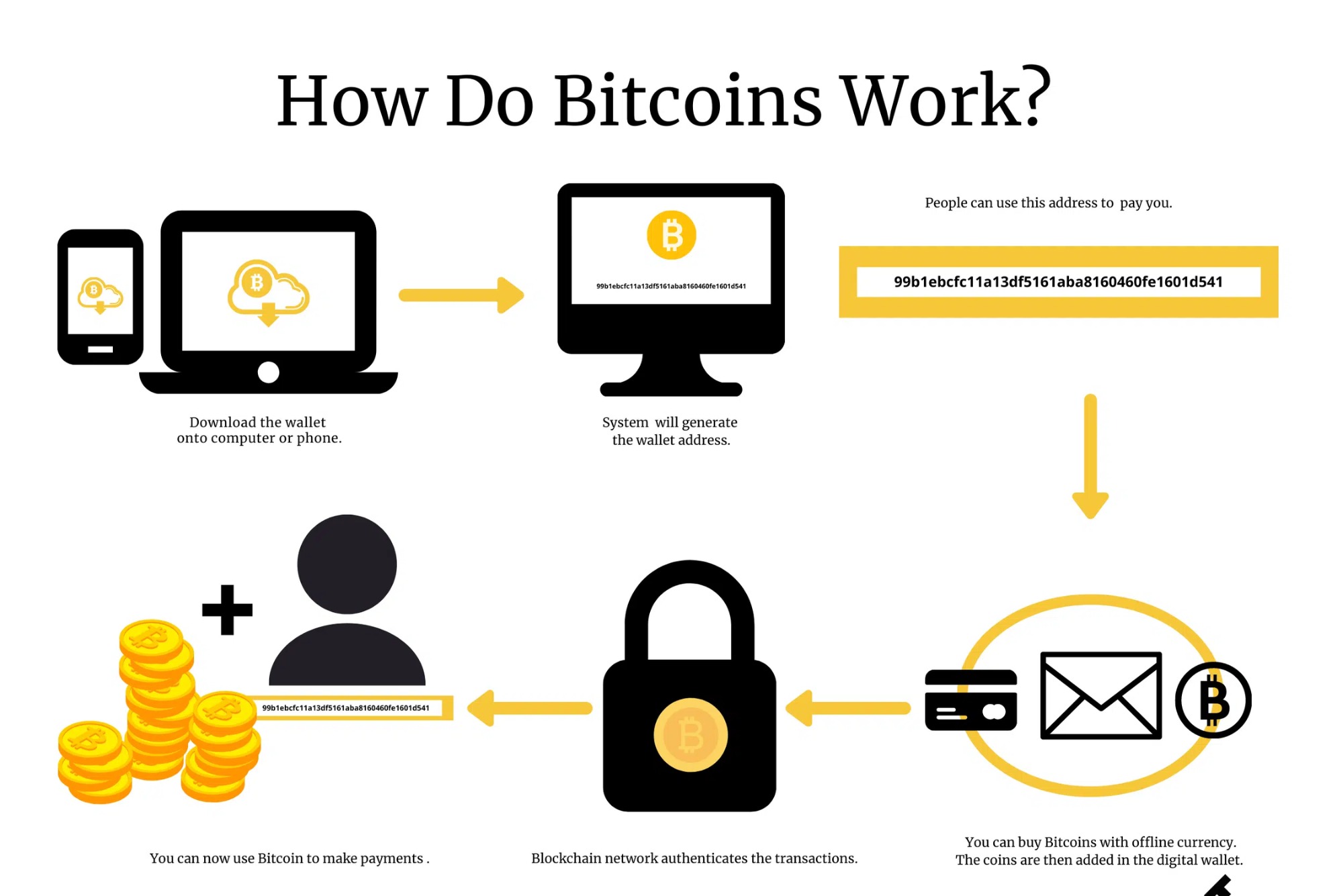

Wallets serve as digital containers for storing bitcoins. They come in various forms, including software, hardware, and paper wallets. Each wallet generates unique addresses for sending and receiving Bitcoin, providing users with full control over their funds.

Transaction Verification: Confirming Legitimacy

Every Bitcoin transaction undergoes verification by nodes on the network. Nodes validate transactions based on consensus rules, ensuring their legitimacy. Once verified, transactions are added to the blockchain and become irreversible.

Scalability Challenges

Despite its revolutionary potential, Bitcoin faces scalability challenges. The limited block size and increasing transaction volume have led to congestion and high fees. Efforts are underway to address these issues through solutions like the Lightning Network and Segregated Witness (SegWit).

Future Outlook

As Bitcoin continues to evolve, its future remains a subject of speculation and debate. From mainstream adoption to regulatory scrutiny, Bitcoin’s journey is marked by both opportunities and challenges. Nevertheless, its underlying principles of decentralization and financial sovereignty continue to resonate with individuals worldwide.

Bitcoin Legend Listing Date

The “Bitcoin legend listing date” refers to the historic moment when Bitcoin was first listed on a cryptocurrency exchange. On July 18, 2010, the now-defunct exchange Mt. Gox listed Bitcoin for the first time, marking a significant milestone in the cryptocurrency’s journey. This event not only provided a platform for trading Bitcoin but also contributed to its growing recognition and adoption within the digital currency community. Today, the listing date holds historical significance as it symbolizes Bitcoin’s emergence as a viable alternative to traditional currencies.